Introduction

Innovation teams are built to move fast.

Financial reporting is built to reduce risk.

In EU-funded projects, especially under Horizon Europe, these two realities collide.

When financial reporting is not structurally embedded into the organisation, innovation teams slow down — not because of compliance itself, but because governance systems are misaligned.

If your organisation relies on EU funding to scale R&D, understanding this friction is critical.

Why Financial Reporting Becomes a Bottleneck in EU-Funded Projects

Why Financial Reporting Becomes a Bottleneck in EU-Funded Projects

Financial reporting in Horizon Europe and other EU grants requires:

- Structured documentation

- Budget ceilings

These are not optional layers. They are embedded in the Grant Agreement framework.

However, in many organisations, EU grant reporting is managed through:

- Fragmented spreadsheets

- Manual cost reconciliation

- Reactive finance controls

This is where financial reporting starts slowing innovation teams.

Not because reporting exists — but because it is disconnected from project execution.

The Real Cost of Poor Financial Reporting Structure

When EU financial reporting is not integrated into daily project management:

- R&D teams pause work to reconstruct documentation

- Finance teams chase missing data

- Reporting cycles become resource-intensive

- Payment flows risk delay

- Audit exposure increases

Over time, the cost is not just administrative.

It becomes strategic. Innovation velocity decreases. Portfolio scalability weakens.

Leadership visibility declines.

Why This Matters for CEOs and Innovation Leaders

For organisations participating in Horizon Europe or other EU-funded R&D programmes, financial reporting is a governance function.

It determines:

- Whether costs are eligible

- Whether funding can be retained

- Whether audits can be passed

- Whether multi-project growth is sustainable

The more projects you run, the more complex financial reporting becomes.

Without system-level control, complexity grows faster than innovation capacity.

This is when reporting becomes a structural brake on growth.

Financial Reporting Should Not Slow Innovation

The problem is not EU grant reporting itself. The problem is treating financial reporting as an afterthought rather than as infrastructure.

When reporting logic is embedded from day one:

- Cost tracking becomes continuous

- Documentation is structured automatically

- Portfolio visibility improves

- Audit readiness becomes ongoing

Innovation teams stop reacting to reporting cycles — and start operating within a stable governance framework.

Scaling EU-Funded Innovation Requires Structured Systems

If Horizon Europe funding is part of your growth strategy, financial reporting must scale with it.

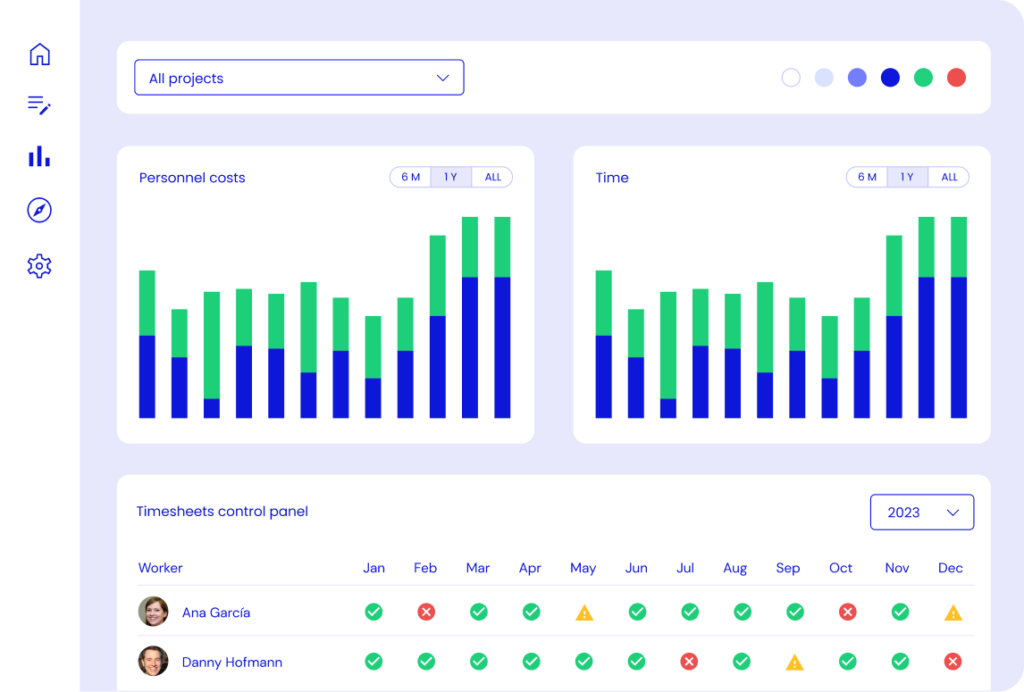

Kronis, developed by Sploro, is a SaaS platform designed specifically for the financial management and justification of European R&D grants.

By centralising project financial data and structuring EU grant reporting workflows, organisations can reduce friction between innovation and compliance.

The objective is not to reduce oversight.

It is to prevent financial reporting from slowing down innovation teams.

Final Thought

Financial reporting slows innovation teams when governance is fragmented. In EU-funded R&D environments, this friction increases as project volume grows.

For leadership teams, the question is not whether reporting is demanding. It is whether your organisation is structurally designed to absorb it without sacrificing innovation speed.

Is Financial Reporting Slowing Down Your R&D Teams? If your organisation manages multiple Horizon Europe or EU-funded projects, book a demo to see how Kronis supports scalable EU-funded R&D management.