Participating in Horizon Europe projects often necessitates travel, which must be carefully managed to align with project budgets and compliance requirements. This article provides a streamlined approach to handling travel expenditures, ensuring they meet the necessary criteria for eligibility and reimbursement.

Criteria for Eligible Travel Costs

Travel expenses must satisfy several criteria to qualify for reimbursement under your Horizon Europe project. Firstly, ensure the expenses are actual costs incurred by you, the beneficiary. Travel should occur strictly within the project’s timeframe and must directly support the project’s objectives, such as attending relevant events or meetings. All travel expenses must be meticulously documented and easily verifiable in your financial records, adhering to both your national laws and the principles of sound financial management.

Reporting and Claiming Travel Costs

When it’s time to report, travel expenses should be categorized under ‘Purchase cost’. The eligible expenses include the cost of transportation (whether by car, train, bus, air, or sea), accommodation, and daily subsistence which generally covers meals. Keeping these expenses organized and well-documented simplifies the auditing process.

Frequent Questions Regarding Project Travel Expenses

Non-Company Personnel and Combined Trips

There are often queries about whether travel costs for individuals who are not company staff can be charged to the project and how to handle trips that blend professional and personal activities. In such cases, only the professional portion of the travel can be claimed, and costs related to non-company personnel require specific justification linked to the project objectives.

Premium Travel Accommodations

Another common question is whether traveling in business class is permissible. Typically, travel should be economical; however, exceptions can be made with proper justification depending on the circumstances and provided they are pre-approved by the project coordinators.

Unforeseen Travel and Pre-Project Bookings

Regarding travel that was not initially planned or included in the Description of Action (DoA), such expenses must be indispensable to the project and thoroughly documented. Travel booked before the official start of the project generally does not qualify for reimbursement unless it occurs within the project’s active period.

Tips and Additional Charges

Lastly, the eligibility of tips included in restaurant bills often arises; only mandatory service charges incorporated into the bill are eligible. Voluntary tips cannot be claimed.

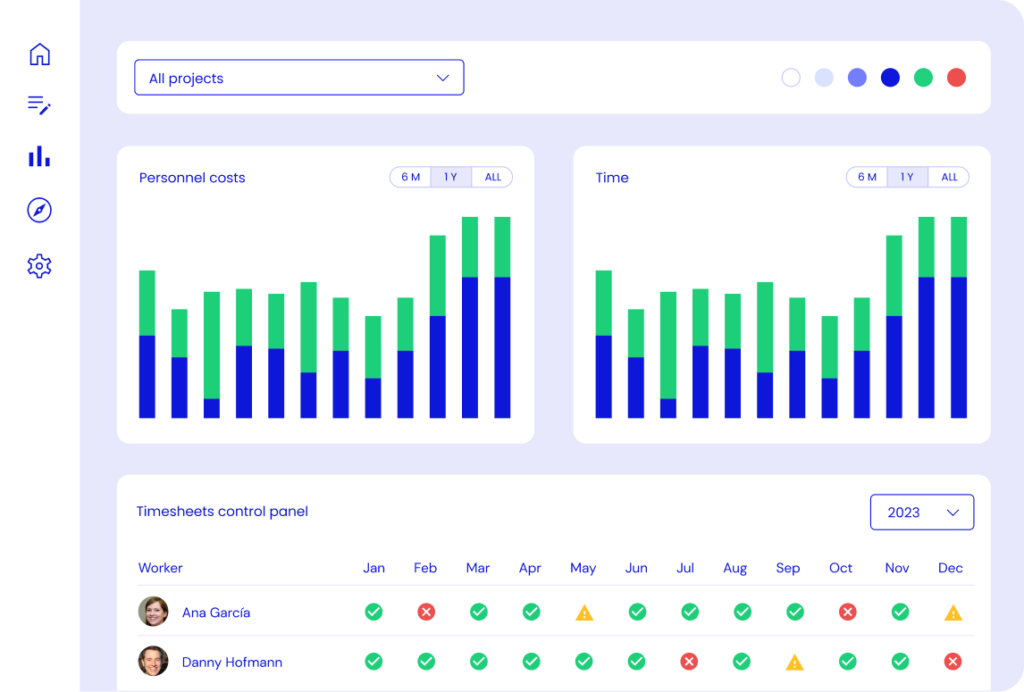

Streamline Your Project Management with Kronis.app

Navigating the complexities of travel expenses in Horizon Europe projects requires careful planning and adherence to specific guidelines. By establishing a robust travel policy and maintaining detailed records, you can ensure that all travel expenditures are compliant, eligible, and optimally managed within the framework of your project.

For a streamlined experience in managing your project’s financials, including travel expenses, consider using Kronis.app. Our tool is designed to simplify the administrative burden of Horizon Europe projects, ensuring you can focus on what matters most—your research and project goals.