In the realm of EU-funded projects, proper accounting is not just a best practice—it’s a pivotal element of compliance. But why is maintaining identifiable and verifiable costs so crucial, and how can organizations ensure they meet these stringent requirements? Let’s delve into these questions, providing actionable insights for beneficiaries of EU grants.

Why Is Identifiable and Verifiable Costing Essential?

At the heart of EU grant compliance lies the principle of transparency. Identifiable and verifiable costs ensure that every euro spent can be traced back to a legitimate, project-related expense. This not only simplifies audits but also builds trust with funding bodies by showcasing a commitment to financial integrity.

How Do Usual Accounting Practices Align with EU Standards?

EU regulations mandate that beneficiaries’ accounting practices must align with their usual procedures, as long as these are consistent with applicable accounting standards. This requirement underscores the need for a solid foundation in standard accounting practices, tailored to the specificities of EU grants.

What Are the Applicable Accounting Standards?

Adhering to international accounting standards like GAAP or IFRS ensures that financial statements are understandable and comparable across borders. For EU grant beneficiaries, this means implementing robust accounting systems that can accommodate these standards, ensuring every transaction related to the grant is recorded and reported accurately.

Practical Examples: Navigating Accounting Challenges

Imagine a scenario where an organization fails to separate EU project costs from its regular expenses. This oversight could lead to ineligible costs being charged to the project, risking financial penalties or even repayment demands. Through practical examples like this, organizations can learn the importance of detailed record-keeping and segregation of funds.

The Consequences of Non-Compliance

Non-compliance with EU accounting standards can lead to severe consequences, including financial audits, penalties, and the requirement to repay grant funds. Understanding these risks is crucial for any organization embarking on an EU-funded project.

How Can Organizations Ensure Compliance?

- Implement an accounting system that supports detailed tracking of project-related expenses.

- Ensure staff are trained on the specific requirements of EU grant accounting.

- Regularly review financial records in line with EU grant guidelines.

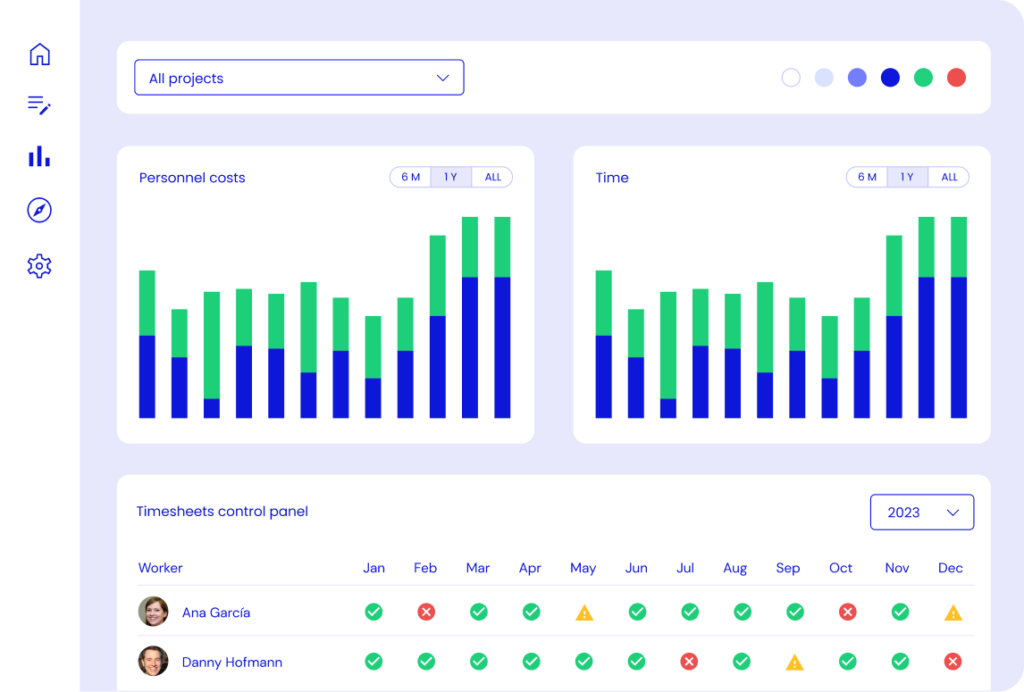

Call to Action: Secure Your Funding with Kronis

Ensuring compliance with EU grant requirements doesn’t have to be daunting. Kronis.app is here to guide you through every step of the process. Visit Kronis.app today and ensure your project’s financial integrity and success.

Proper accounting is the cornerstone of EU grant compliance. By maintaining identifiable and verifiable costs, aligning with standard accounting practices, and adhering to applicable standards, organizations can navigate the complexities of EU funding with confidence. Remember, compliance is not just about avoiding penalties—it’s about demonstrating accountability and maximizing the impact of your funded project. With the right approach and resources, such as those provided by Kronis.app, achieving compliance is within reach for any organization.