Simple rules for reporting indirect costs in Horizon Europe—no confusion, no surprises.

Introduction

Indirect costs—also known as overheads—are often a mystery for project teams new to Horizon Europe. What are they? How does the flat rate work? Do you need receipts or invoices? The truth is, this is one area where the rules are simple and generous—if you follow them carefully.

This article explains, in plain language, what indirect costs really are, how to calculate them, and what you need (and don’t need) to stay compliant and audit-ready.

What Are Indirect Costs?

Indirect costs are general expenses that support your Horizon Europe project, but cannot be tied to a specific activity, deliverable, or person.

Think of them as the “background costs” that keep your organisation running—without them, your team couldn’t do its project work, but you can’t attribute them to just one project or task.

Examples of indirect costs:

- Rent for office space where your team works

- Electricity and water bills

- Building maintenance

- Use of shared IT infrastructure (internet, servers, software licences used by the whole organisation)

- Salaries for general administrative staff (like HR, finance, or receptionists)

- Cleaning services

- General supplies (stationery, shared printers, etc.)

Why not claim these as direct costs?

Because these resources are shared across all your organisation’s projects and activities. It’s almost impossible (and inefficient) to split and assign every euro to a particular project. That’s why Horizon Europe uses a flat rate: to keep things simple and fair for everyone.

Example:

Let’s say you coordinate a Horizon Europe project at a university. Your research team uses offices, internet, heating, and benefits from the support of the university’s central HR and finance teams. All these costs support your project, but also dozens of other projects and activities happening at the university.

Rather than trying to measure exactly how much of the rent or electricity bill your project used, the European Commission lets you claim 25% of your eligible direct costs as indirect costs.

So, if you spend €120,000 on direct costs (excluding subcontracting and third-party funding), you automatically receive €30,000 to cover these shared overheads—no receipts or invoices needed.

Key takeaway:

Indirect costs are there to make your life easier. As long as your direct costs are accepted and your calculation is correct, you get the full flat rate—no extra paperwork or justification required.

Flat Rate vs Real Costs: What’s the Difference?

One of the main sources of confusion in EU projects is the difference between the flat rate system (used in Horizon Europe) and claiming real indirect costs (used in some other funding schemes).

Flat Rate (Horizon Europe Standard)

In Horizon Europe, indirect costs are calculated automatically as a percentage (25%) of your eligible direct costs.

This approach keeps things simple for both project managers and auditors.

Example:

- Your project’s eligible direct costs (excluding subcontracting and financial support to third parties): €80,000

- Indirect costs (flat rate): €80,000 × 25% = €20,000

You do not need to submit any receipts or invoices for these €20,000. The system is designed to save time and reduce errors.

Real Costs (Not Used in Horizon Europe)

In some older EU programmes or national grants, organisations could claim the actual amount they spent on overheads, based on bills and careful calculations (for example, measuring how much office rent or utilities a project really used).

But in Horizon Europe, this is NOT allowed:

- You can’t claim actual invoices or higher percentages for overheads—even if your true costs are more than 25%.

- No extra justification is accepted beyond the standard calculation.

Why does this matter?

Because some organisations are used to the “real cost” model and try to add extra evidence, or even claim both flat rate and actual overheads. This leads to rejected costs.

What Should You Do?

- Always use the 25% flat rate—never claim real indirect costs in Horizon Europe.

- Double-check which direct costs should be included in the base calculation.

- Don’t overcomplicate: if you use the flat rate correctly, your indirect costs are accepted automatically.

Key takeaway:

Horizon Europe’s flat rate saves you work—just make sure you apply it correctly, and you’ll avoid confusion, errors, and audit stress.

What Can (and Can’t) Be Included?

Included as indirect costs:

- Office rent and maintenance

- Utilities (electricity, water, heating)

- IT infrastructure and support

- General administrative staff (not directly working on project tasks)

- Supplies and services used by the whole organisation

Excluded from indirect costs:

- Subcontracting costs

- Financial support to third parties

- Direct costs already claimed elsewhere (e.g., specific equipment depreciation)

- Any costs claimed directly in the project budget

Key point:

You don’t need to keep or submit receipts, invoices, or detailed calculations for these costs. The flat rate covers all eligible indirect costs, as long as your direct costs are accepted.

Typical Pitfalls

- Trying to claim real indirect costs:

Do not submit invoices or attempt to claim your organisation’s actual overheads—only the 25% flat rate is eligible.

- Including ineligible direct costs in the calculation:

Remember to exclude subcontracting and financial support to third parties when applying the flat rate.

- Reporting the same cost as both direct and indirect:

For example, if you claim electricity for the lab as a direct cost, you cannot also include it in your indirect costs.

- Overcomplicating documentation:

Don’t waste time collecting invoices or trying to “prove” indirect costs. Focus on making sure your direct costs are compliant—the indirects are calculated automatically.

Final Thought

Indirect costs don’t need to be complicated. With Horizon Europe’s flat rate, you have a simple, transparent way to cover your overheads—no paperwork, no stress. Just make sure your direct costs are eligible, your calculations are clear, and you’re applying the rules correctly.

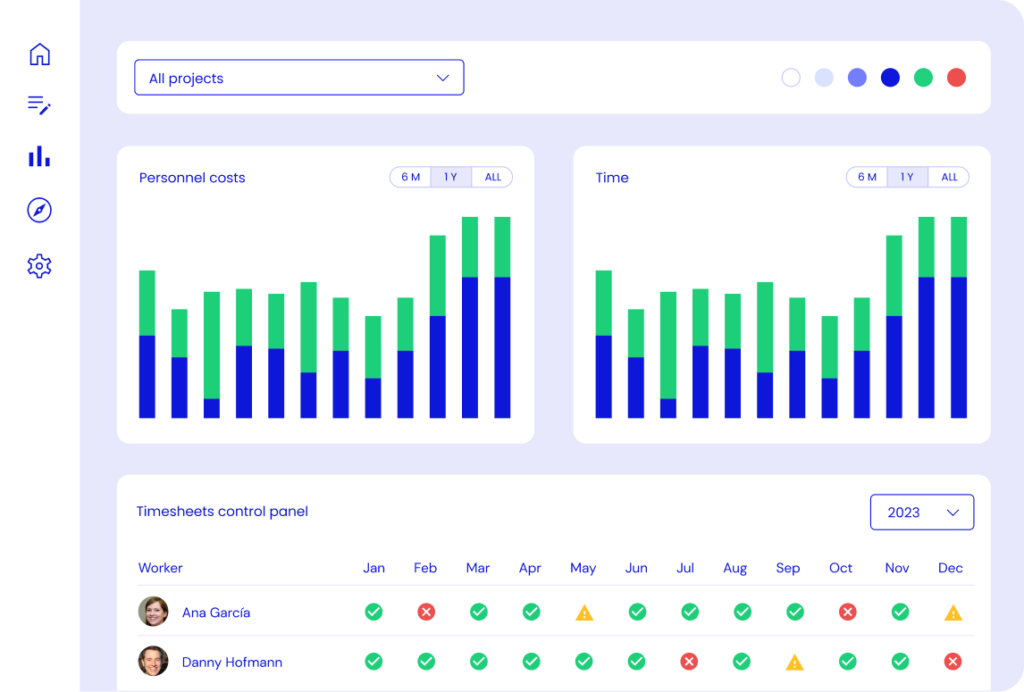

With Kronis, you can handle indirect costs (and all your project finances) with total confidence.

Article 6 in Horizon Europe: Practical Tips for Eligible and Ineligible Costs