“Wait, what?”

Yes, you read that right. If you’re an SME owner participating in Horizon Europe projects, you might be missing out on a significant financial benefit.

“But you don’t know what you’re talking about. My salary is way lower than that.”

Then you might be managing your Horizon grants incorrectly.

Horizon Europe’s Flat-Rate Grant for SME Owners Without a Salary

Here’s the thing: Horizon Europe allows SME owners who don’t receive a salary to claim a flat-rate grant for their time spent on the project. Up until recently, this flat rate was around €6,000 per month. That’s not bad at all—you could invoice your company, take dividends, or leave the money in the business if you didn’t need it.

But things have changed, and the update is big news.

Let us quote the official communication from the European Commission:

“The eligible direct personnel costs declared by beneficiaries that are SMEs for their owners not receiving a salary shall therefore be based on a unit cost per day-equivalent worked on the action to be calculated as follows: €8,745.4, multiplied by the relevant country-specific correction coefficient divided by 18 days.”

That’s right: the new flat rate is over €8,700 per month for SME owners not receiving a salary.

What Does This Mean for You?

If you’re currently drawing a lower salary as an SME owner involved in Horizon Europe projects, you might want to reconsider. The rules have changed for calls opening from August 1, 2024, which means projects starting in the second half of 2025 will need to follow these new guidelines.

But don’t panic if you already have running projects—you can continue as usual until the end of the year. After that, when you start winning new Horizon projects, it’s time to do the math.

The 18 Days and Day Equivalents: What’s Going On?

You might be wondering about the “18 days” in the calculation. Horizon Europe’s system is based on day equivalents worked on the action, and I’ll go into more detail about this in another post. Just know that rounding and day calculations are often tricky with Horizon Europe grants, but Kronis has your back.

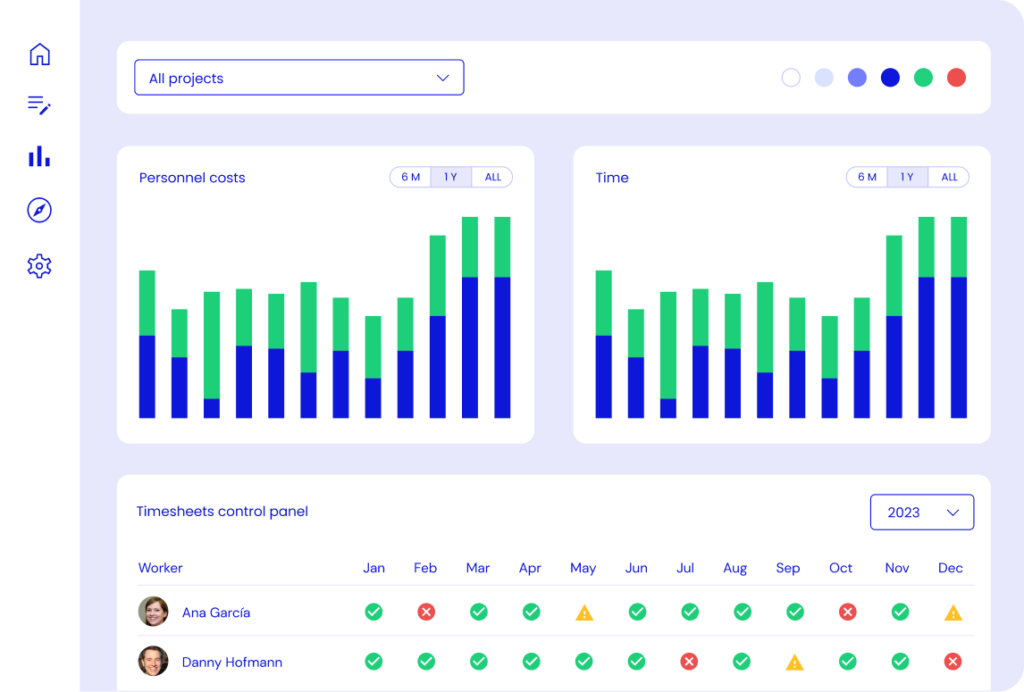

How Kronis Simplifies Your Reporting

We built Kronis specifically to make the financial reporting of Horizon Europe projects easier. Kronis automatically calculates the flat rates based on the year of the grant, ensuring that you’re applying the right rate for your specific situation. Whether you’re managing multiple grants or just one, Kronis is clever enough to handle the updates with no hassle.

Kronis is your best-in-class software tool for Horizon Europe financial reporting. With a 30-day free trial, you can see for yourself how it simplifies your life as an SME owner. After that, we can talk about the license.

Should You Make a Switch?

If you’re currently under a salary, it might be worth considering a shift to the flat-rate grant system in 2026. You could also take a transition year in 2025 to adapt to the new rules.

And don’t forget—Kronis does all the hard work for you. With automated flat-rate calculations and built-in compliance for Horizon Europe’s ever-changing rules, you’ll never have to worry about missing out on what’s rightfully yours.

Start your free trial with Kronis today and discover how our platform can help you maximize your financial reporting for Horizon Europe grants.