A clear, step-by-step guide to understanding, registering, and reporting affiliated entities or linked third parties in Horizon Europe—so you never lose funding over a technicality.

Introduction

Buying equipment or materials is often essential for your Horizon Europe project. But when it comes to reporting and justifying these direct costs, even experienced teams can make mistakes that lead to rejected expenses or lost funding.

The good news: with a few clear rules and good habits, you can keep your budget safe and pass any audit—no stress required.

What Counts as Equipment and Other Direct Costs?

Equipment costs:

These include computers, lab machines, instruments, software, and any assets you need to achieve your project’s objectives.

Example:

- Your research team needs a high-resolution microscope for project experiments. The microscope costs €10,000, but it’s only used 30% of the time on Horizon Europe tasks and is deprecated during the project lenght

- Eligible cost: €10,000 × 30% = €3,000

Remember: Only the portion used for the project is eligible. Additionally, only the portion based on the deprecation cost of the asset during the period of use in the project, not over the whole purchase price. If the equipment is shared with other activities, you must calculate and justify the percentage.

Other direct costs:

This covers project-related purchases such as:

- Consumables (lab reagents, parts, test kits)

- Travel expenses (recommended to have a travel policy)

- Project-specific services (consulting, data collection, technical analysis)

- Small tools, spare parts, or software licenses

Example:

- You buy special lab reagents (€500) used only for project experiments.

- You purchase a one-year software license (€300) for project data analysis.

- You go to Brussels for a consortium meeting (€750)

All are eligible because they are used only for Horizon Europe and are documented with invoices and payment proofs.

Key principle

To be eligible, all costs must be:

- Necessary for the project’s work

- Clearly linked to the tasks in your Description of Action (Annex 1)

- Properly documented (quotes, invoices, payment proofs)

- Reasonable and in line with market prices

The Golden Rules for Eligibility (Article 6)

Actual costs only:

You can only claim what you really paid, supported by invoices and proof of payment—no estimates or lump sums.

- Example: You pay €1,200 for spare parts and €80 for shipping. You claim exactly €1,280, with invoice and payment proof.

Depreciation applies:

For equipment, you usually claim only the depreciation (the portion “used up” during the project), unless the equipment was purchased exclusively for the project and fully used during its duration.

- Example: You buy a 3D printer for €5,000. The project lasts 2 years, the printer’s useful life is 5 years.

Eligible cost: €5,000 × (2/5) = €2,000

No double funding:

Costs must not be funded by another project or source.

- Example: You cannot charge the same computer to both Horizon Europe and a national grant.

Purchase in line with your organisation’s policies:

Follow your internal procedures for procurement and asset management, and keep a record of each step.

- Example: Your university requires three supplier quotes for purchases over €2,000; you follow this rule and keep all quotes for audit.

Keep everything audit-ready:

Store all purchase approvals, tender docs, supplier offers, delivery notes, and any usage logs required.

- Example: For a piece of equipment, keep quotes, approval email, invoice, bank statement, delivery note, and a usage log for project-related activities.

Common Mistakes

Even experienced teams make mistakes when justifying equipment and direct costs. Here are some of the most frequent pitfalls—and how to avoid them:

- Not calculating the correct usage percentage:

Some teams try to claim 100% of the equipment cost, even though the asset is used for other projects as well.

Solution: Always calculate and justify the real percentage used for the Horizon Europe project, and document your calculation.

- Forgetting depreciation:

Claiming the full cost of equipment that will still be used after the project ends.

Solution: Apply the correct depreciation according to the asset’s useful life and the project period.

- Missing proof of payment or delivery:

Keeping only the invoice, but not the bank statement or delivery note.

Solution: Always save proof of payment and a document showing the item was delivered and received.

- Ignoring internal procurement rules:

Not following your organisation’s requirements (like collecting multiple quotes or getting approvals before purchase).

Solution: Always follow internal procedures and keep records for audit purposes.

- Charging non-eligible items:

Including unrelated or personal expenses, or general office supplies not linked to the project.

Solution: Only claim items directly related to the project and described in the Grant Agreement.

What Documents Should You Keep?

To justify equipment and direct costs in Horizon Europe, always keep:

- Quotes and supplier offers (especially for significant purchases)

- Purchase orders and internal approval forms

- Invoices with clear descriptions

- Proof of payment (bank statement or transfer confirmation)

- Delivery notes or acceptance reports

- Usage log or records showing the percentage of use for the project

- Maintenance or warranty records (if relevant)

- Internal procurement documentation (such as evidence of competitive selection)

- Any email correspondence or communications related to the purchase

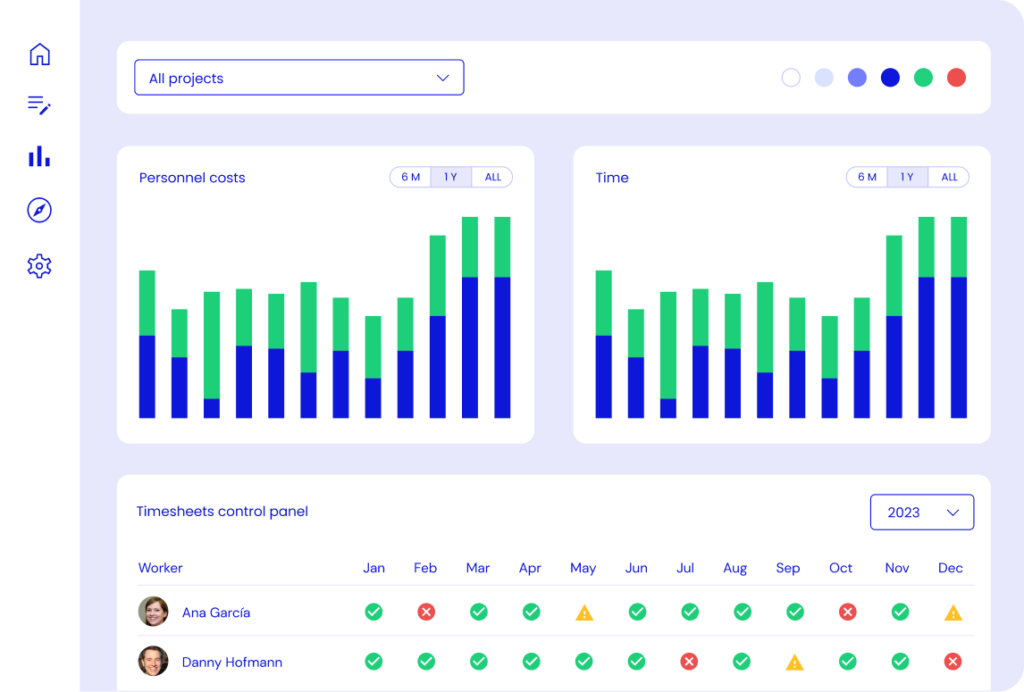

Pro tip: Store these documents in a digital folder, or upload them to Kronis, so everything is organised and accessible if an auditor requests them. Tip: Store these documents in a digital folder, or upload them to Kronis, so everything is organised and accessible if an auditor requests them.

Final Thought

Equipment and direct costs are essential for driving innovation in Horizon Europe—but only if you justify them properly. The rules may seem strict, but with careful planning, good documentation, and simple routines, you can avoid costly mistakes and secure your project’s funding.

Kronis makes the process even easier: centralise every document, set reminders for missing files, and generate audit-ready reports with a single click. This way, you can focus on research and results—instead of paperwork stress.

Article 6 in Horizon Europe: Practical Tips for Eligible and Ineligible Costs