A beginner-friendly, practical guide to claiming, documenting, and justifying staff costs—based on Article 6 of the Grant Agreement.

Introduction

Personnel costs are usually the biggest part of any Horizon Europe project budget. But they’re also the most frequently questioned by auditors. If you want to avoid rejections, delays, or lost funding, it’s essential to understand how to justify salaries, hours, and staff time—step by step.

Don’t worry if you’ve never done it before: with the right process, you can get it right from day one.

What Counts as Eligible Personnel Costs? (Article 6 Explained)

When it comes to personnel costs in Horizon Europe, only certain expenses are considered eligible—meaning, only these can be reimbursed by the EU. Article 6 of the Grant Agreement sets out the basic rules, but here’s what you really need to know (without legal jargon):

Who can you include?

- Employees officially hired by your organisation, with a valid contract (full-time, part-time, fixed-term, or permanent).

- Their work must be directly linked to the project—no “generic admin” or unrelated roles.

- Both researchers, project managers, support staff, and even technical or administrative profiles can be eligible—if their work is necessary for the project.

What costs can you claim?

- Basic salary: The regular gross salary defined in the contract.

- Employer contributions: Social security, health insurance, pension, and other mandatory costs paid by the employer.

- Taxes: Any taxes on employment, if applicable.

- Standard bonuses/allowances: Only if they are part of your usual company policy and included for all similar staff (not just “project-only” bonuses). Nevertheless, elements like dividends, bonuses based on commercial targets or that are paid only if there are remaining funds in the budget of a project need to be excluded in the calculation.

- Freelancers and consultants: Only if they are remunerated under similar conditions as the usual employees, their costs can be considered personnel costs under the category of “Natural persons under a contract” or “Seconded persons”. Similar conditions entail they need to report their time as a normal employee and having a salary equivalent to their category.

- Bonuses or payments that are exceptional, one-off, or invented just for the project.

- Costs not supported by a real work contract or payslips.

- Freelancers working under significantly different conditions as the employees are considered subcontracting.

Key conditions for eligibility:

- The staff must actually work on the project, and you must be able to prove it (with timesheets and documentation).

- Costs must be based on real, paid salaries (not estimates or “flat rates”).

- You can only claim for the time they spent on project work—no more, no less.

Example 1:

Let’s say your organisation has a project manager, María, who works full-time and earns €3,000 gross salary per month (including social security and taxes). If María spends 40% of her time on the Horizon Europe project during March, you can claim 40% of her actual personnel cost for that month—so €1,200.

- Eligible cost for March: €3,000 × 40% = €1,200

- What you need: María’s signed contract, March payslip, proof of payment, and a signed timesheet showing 40% of her working time on the project.

This way, if there’s ever an audit, you can show exactly how you calculated the claim, and that it matches the real work María did.

Example 2: Handling Changes During the Project

Let’s imagine your researcher, Alex, starts the year working full-time on your Horizon Europe project. In June, Alex’s contract changes—he moves to a part-time schedule (50%) and also starts working on a different project.

How do you justify Alex’s personnel costs?

- From January to May:

If Alex worked 100% on the project, you can claim 100% of his actual monthly personnel cost for those months.

-

- E.g., salary + social contributions for each month, proven by payslips and timesheets.

- From June to December:

Alex is now part-time, and only spends 60% of his reduced hours on the Horizon Europe project.

-

- You must calculate his new monthly salary (now part-time).

-

- Claim only the share of his working time spent on the project each month.

For example, if his part-time salary is €2,000/month and he spends 60% of his time on the project: - Eligible cost per month: €2,000 × 60% = €1,200

- Claim only the share of his working time spent on the project each month.

- What you need to keep:

-

- Original and new contract showing change in working hours

-

- All payslips before and after the change

-

- Timesheets clearly showing the % of time worked on the project each month

-

- Proof that both changes (hours and allocation) were approved and documented

Key takeaway:

Always update your records (contracts, timesheets, payroll) as soon as there’s any change in staff situation. This will make your reporting clear and keep your costs eligible—even if someone’s role or contract changes during the project.

How to Calculate and Document Personnel Costs

Calculate Productive Hours

- Always use your organisation’s standard method for calculating annual productive hours ( 1,720 hours/year as a baseline, unless your national law or internal policy sets a different figure).

- If an employee works part-time, or only part of the year, adjust their total annual hours and eligible costs accordingly.

- Tip: Keep a record of the method used and any changes in working time, so you can explain your calculations during an audit.

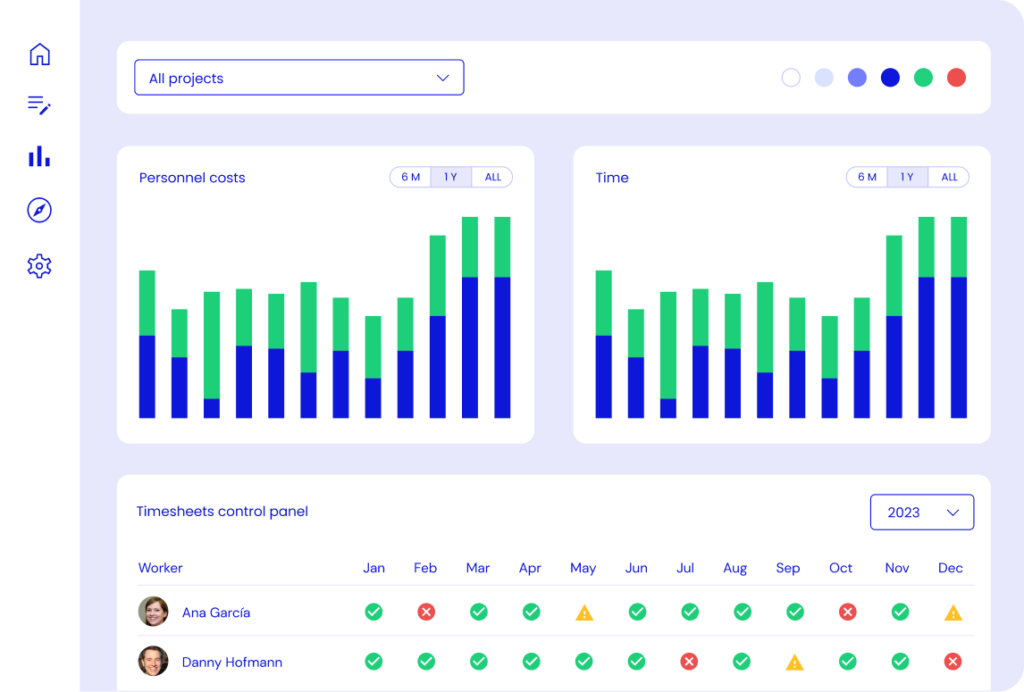

Track Time with Timesheets

- Every person working on the project must complete timesheets, clearly showing:

- Dates and hours/days worked

- The tasks or work packages performed

- The name of the project (Horizon Europe)

- Timesheets must be signed (digitally or on paper) by both the employee and their supervisor every month—this is a common audit requirement.

- Tip: Fill out timesheets regularly, not just at the end of the reporting period. Kronis can automate reminders and digital signatures to make this easy.

Collect Payslips and Contracts

- Save a copy of every monthly payslip for each employee whose costs are claimed.

- Store the signed employment contract for each staff member (showing job title, salary, and dates).

- Keep internal payroll records (salary calculations, social security contributions) and proof of payment (bank statements or payroll transfers).

- Tip: Organise these documents in a digital folder (or within Kronis), so you can find them instantly if requested.

Link Costs to the Project

- Your documentation should clearly connect each person’s time and cost to your Horizon Europe project.

- Use project codes, clear file names, or digital tools like Kronis to make this linkage obvious for both internal reviews and external audits.

Example: Calculating Personnel Costs for a Researcher

Let’s say Marta is a researcher with a full-time contract at your organisation. Her annual gross salary (including social security and employer contributions) is €36,000.

- Your organisation uses the standard 1,720 productive hours/year or 215 DEq/ear. Note Horizon Europe uses Day Equivalents for the calculation.

- In March, Marta works 60 hours on the Horizon Europe project.

Step 1: Calculate Marta’s daily rate

- €36,000 annual salary / 215 = 167,44€ per DEq

Step 2: Calculate her eligible cost for March

- 60 hours / 8 h/DEq = 7,5 DEqs

- 167,44€/DEq x 7,5DEqs = €1,255.80

Step 3: What documents do you need?

- Marta’s signed contract (shows salary and full-time status)

- March payslip

- Signed timesheet for March (showing 60 hours on the project, signed by Marta and her supervisor)

- Payroll proof (bank statement or payroll export showing salary paid)

- Internal calculation (showing how you reached €167.44 / DEq)

Tip:

If Marta switches to part-time or joins another project, adjust the calculation based on her new situation and always keep updated documents for each change.

Common Mistakes (and How to Avoid Them)

- Missing or unsigned timesheets:

Auditors will reject personnel costs without full, signed timesheets.

Solution: Set monthly reminders for signatures and reviews.

- Claiming costs for staff not working on the project:

Only staff with a real role and documented project work are eligible.

- Wrong calculation of productive hours:

Double-check the method—using the wrong denominator can invalidate your claims. Use Day Equivalents to meassure time and conversions. You cannot run the calculations only IN HOURS.

- No proof of payment:

Always keep payslips, payroll bank statements, and social security proofs.

- Including bonuses not standard in your organisation:

Only standard, contractually agreed bonuses are eligible.

What Documents Should You Keep?

To justify every euro of personnel cost, always keep:

- Signed timesheets (monthly)

- Payslips and proof of payment

- Employment contracts

- Social security and tax documents

- Internal payroll records

- Approval emails or project allocation forms

Pro tip: Scan and store all documents in a dedicated digital folder—or, even better, use Kronis to automate the process.

Final Thought

Getting personnel costs right is all about routine, organisation, and using the right tools. Build good habits from the start, and you’ll avoid stress at reporting time—and keep every euro you deserve.

With Kronis, it’s never been easier to stay compliant and audit-ready.

Indirect Costs in Horizon Europe: Flat Rates, Real Costs, and How to Stay Compliant

Equipment & Direct Costs in Horizon Europe: How to complete the financial statement