Confused about what costs are really eligible in EU projects? You’re not alone. This guide breaks down the rules (and the grey areas) with examples, so you never risk your funding.

The Real Challenge of Cost Eligibility in EU Grants

Article 6 Explained: The Golden Rule of Eligible Costs

At the heart of every EU grant lies Article 6 of the Annotated Model Grant Agreement: only costs that are necessary, linked to the project, incurred within the project period, verifiable, and not double-funded are eligible.

- Actually incurred by the beneficiary: Costs must reflect real expenses or work carried out by your organisation.

- Direct link to your project: Expenses must support your work packages, deliverables, or project objectives.

- Project period only: Only costs incurred during the official project period are generally eligible. Exceptions include travel for kick-off or closing meetings (even if part of the journey falls outside the project period) and costs for drafting and submitting the final report.

- Reasonable and necessary: Costs must be justified, proportionate, and avoid luxury or unnecessary spending.

- Documented and verifiable: Keep proper records such as invoices, contracts, timesheets, and other supporting documentation. Costs must be traceable in your accounts according to national accounting standards and your usual practices.

- Compliant with local law: All expenses must follow EU rules and your organization’s national law, including taxes, labor, and social security regulations.

- No double funding: Never claim the same cost in two multiple grants.

Pro tip: When in doubt, ask yourself: Would an auditor agree this cost is necessary and justified for the project?

Where Teams Get Confused (and How to Get It Right)

Some costs are obvious. Others? Not so much. Here’s where confusion usually strikes:

- Travel & accommodation: Only for project-specific tasks, and always with clear justification (agenda, invite, etc.).

- Equipment: Only depreciation for the project period—not the full purchase—unless allowed.

- Subcontracting: Must be approved and properly documented. The beneficiary must award the contracts and subcontracts on the basis of best value for money (or lowest price) and absence of conflict of interests.

- VAT: Can only be included if you cannot recover it nationally.

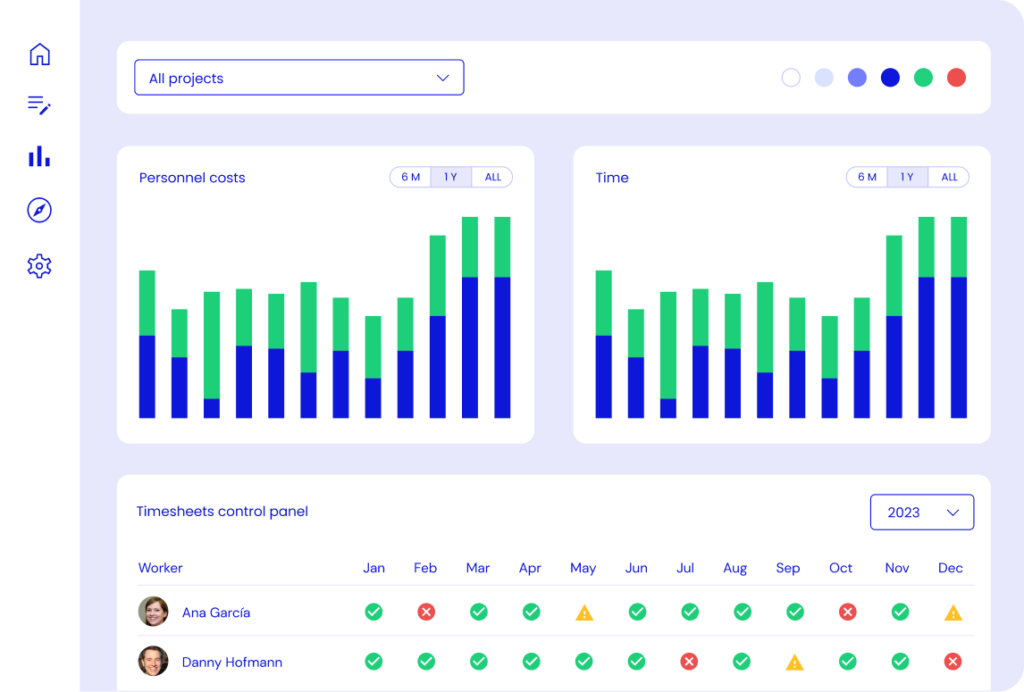

- Personnel: Timesheets and employment contracts are a must.

- Indirect costs: Apply the correct flat rate—usually 25%—on eligible direct costs.

Examples: Eligible vs Ineligible Costs

Eligible Costs

Ineligible Costs

- Salaries (with timesheets)

- Project travel (with agenda/invite)

- Equipment depreciation for project use

- Consumables used only in the project

- Approved subcontracting (with contract)

- Non-recoverable VAT

- Entertainment, gifts, or fines

- Non-project travel or personal trips

- Full equipment purchase (if not allowed)

- General office supplies

- Subcontracting without approval

- Recoverable VAT

Common Mistakes (And How to Avoid Them)

Even organised teams slip up. The usual suspects:

- Reporting costs that aren’t fully linked to the project.

- Missing or incomplete documentation.

- Claiming costs outside the project period.

- Assuming “if it’s a project cost, it must be eligible”—not always true.

- Not updating team members as rules or templates change.

FAQ: Eligible Costs in EU Grants

Can salaries of employees working on the project be included?

Yes, salaries are eligible if they correspond to actual hours worked on the project and are properly documented.

Are subcontracting costs always eligible?

Only if justified in the grant agreement, necessary for project execution, and invoiced at reasonable rates. Documentation of the selection process is recommended.

What costs are most often rejected?

Costs not directly related to the project, unsupported by proper documentation, or misclassified are often rejected. Recoverable VAT is usually also not eligible.

Can I include VAT?

Only if it cannot be reclaimed from your national tax authority.

Are digital copies of documents enough?

Yes, as long as they are clear, complete, and include all required information, though keeping originals is recommended.

How does Kronis help?

Kronis helps by organizing all your project costs and documentation in one place, ensuring your records are complete and ready for reporting. It simplifies tracking, reporting, and preparing for audits, making financial management of EU projects much easier.

Getting eligible costs right means your project keeps its funding—and your team keeps its sanity.

With Kronis, you’ll always know what’s allowed (and what’s not), stay audit-ready, and never lose a euro to a technicality.

Want to see how easy compliance can be? Book a free demo with Kronis and take the guesswork out of EU funding.

Indirect Costs in Horizon Europe: Flat Rates, Real Costs, and How to Stay Compliant

Equipment & Direct Costs in Horizon Europe: How to complete the financial statement