In Horizon Europe projects, ensuring that all costs are identifiable and verifiable is crucial for compliance and successful grant management. Cost identifiability means that every cost can be traced back to the source, while cost verifiability ensures that these costs are documented and can be verified by auditors. This article explores the key principles and best practices for managing costs to meet Horizon Europe’s stringent requirements.

Understanding Cost Identifiability and Verifiability

Cost Identifiability involves being able to trace costs to specific activities, outputs, or objectives of the project. It requires clear documentation that shows how costs are linked to the project’s goals. For instance, if a cost is related to personnel, there should be detailed records indicating which project tasks the personnel were working on, the hours spent, and how these tasks contribute to the project’s objectives.

Cost Verifiability means that costs are documented in a way that auditors can verify their accuracy and relevance. This includes maintaining proper records and justifications for all expenses. For verifiability, it’s essential to have all financial transactions, including the smallest ones, backed by evidence such as receipts, invoices, contracts, and proof of payment.

Key Requirements for Cost Identifiability

- Documenting Cost Elements

- Invoices and Receipts: Ensure that all expenses are backed by invoices, receipts, or other formal documents. These documents should include detailed descriptions of the goods or services provided, the supplier’s details, and the date of the transaction. For example, an invoice for laboratory equipment should specify the items purchased, their quantities, unit prices, and total cost.

- Payment Proofs: Maintain bank statements, proof of payment, and any other relevant financial documents. This might include copies of cheques, online payment confirmations, or bank transfer records. These proofs must correlate with the invoices and receipts to provide a complete audit trail.

- Cost Allocation Records

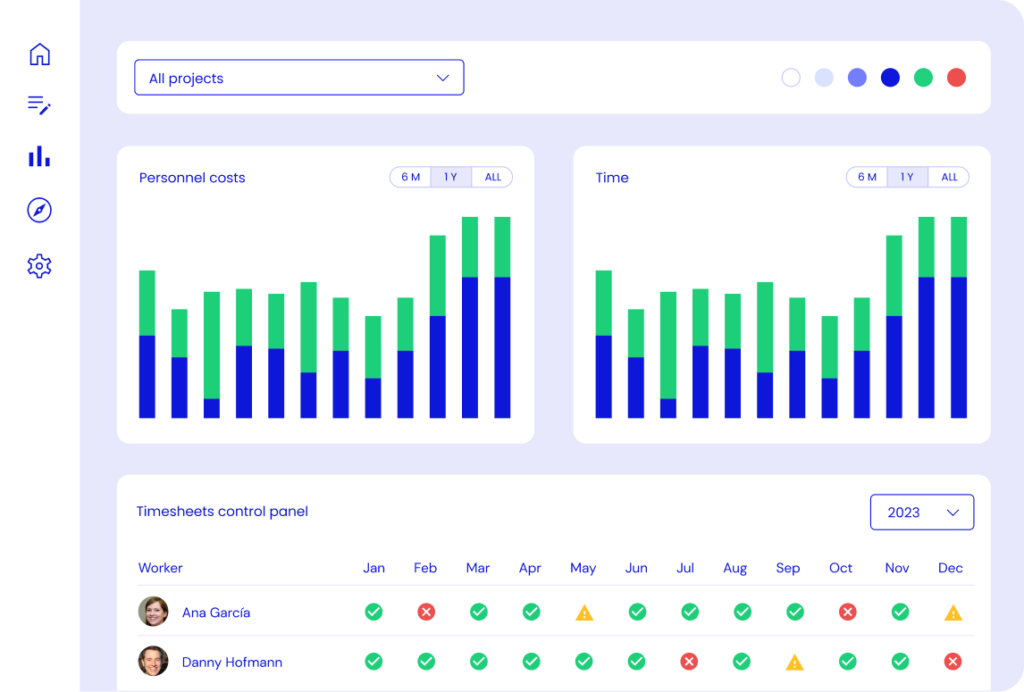

- Timesheets: For personnel costs, timesheets should clearly show the time spent on different tasks related to the project. Each entry should include the date, hours worked, description of the task, and the project work package or task it relates to. This ensures transparency and makes it easier to link personnel costs to specific project activities.

- Allocation Methods: Document the methods used to allocate costs between different activities or between the project and other operations. This includes using logical and consistent allocation keys, such as the proportion of time spent on the project versus other work. These methods should be predefined and consistently applied.

- Project Financial Records

- Accounting Records: Keep detailed accounting records that match the cost categories defined in the grant agreement. This involves using project-specific codes in your accounting software to track expenditures by category, such as personnel, travel, equipment, and consumables.

- Supporting Documentation: Store all documents related to project expenditures, including contracts, invoices, and internal reports. For instance, a contract with a subcontractor should detail the scope of work, deliverables, timeline, and payment terms. All changes to contracts should also be documented and stored.

Best Practices for Ensuring Cost Verifiability

- Regular Audits and Reviews

- Internal Audits: Conduct regular internal audits to ensure that all costs are documented and comply with Horizon Europe’s rules. Internal audits can help identify and rectify issues early, such as missing documentation or misallocated costs.

- Pre-Audit Reviews: Perform pre-audit reviews to identify and correct any potential issues before the formal audit. This includes verifying that all documents are complete, accurate, and easily accessible. A pre-audit checklist can be useful to ensure all areas are covered.

- Clear Financial Procedures

- Financial Policies: Develop and document financial policies and procedures that outline how costs are managed, recorded, and reported. These policies should cover all aspects of financial management, including procurement, cost allocation, and documentation requirements.

- Training Staff: Ensure that all staff involved in financial management are trained in Horizon Europe’s cost rules and procedures. Regular training sessions and updates on any changes in regulations can help maintain compliance.

- Maintaining Detailed Records

- File Organization: Organize files and records systematically to make it easy for auditors to review documents. This includes maintaining both digital and physical copies of all important documents, if possible.

- Electronic Documentation: Use electronic systems for document management to ensure that all documents are easily accessible and well-organized. This can involve using project management software that integrates financial management features or cloud storage solutions for easy access and backup.

Common Challenges and How to Overcome Them

- Inadequate Documentation

- Challenge: Often, insufficient or missing documentation can lead to non-compliance and potential financial penalties. Auditors require comprehensive documentation to verify that all costs are justified and align with the project’s objectives.

- Solution: Implement a document management system that ensures all costs are supported by proper documentation. Regularly review documentation to ensure completeness and accuracy. For example, set up a checklist for each expense type to ensure all necessary documents are attached before approval.

- Misallocation of Costs

- Challenge: Incorrect allocation of costs can lead to audit findings and financial corrections. This often happens when costs are allocated based on convenience rather than actual use or benefit to the project.

- Solution: Use clear and consistent methods for cost allocation and document the rationale behind these methods. Develop allocation keys based on objective criteria, such as the number of hours worked or the proportion of project-specific outputs.

- Non-compliance with Financial Regulations

- Challenge: Misunderstanding or ignoring Horizon Europe’s financial regulations can result in non-compliance, financial penalties, or even grant termination.

- Solution: Stay updated with the regulations and seek advice from experts when necessary. Regularly review the Annotated Model Grant Agreement and other relevant documents. Participate in training sessions or workshops on Horizon Europe’s financial rules.

Example of a Well-Documented Cost

For a personnel cost, you might have:

- Invoice: An invoice from a consultant detailing the hours worked, tasks completed, and the agreed hourly rate.

- Timesheet: A timesheet showing the hours worked on specific project tasks, signed by the consultant and the project manager.

- Proof of Payment: A bank statement showing the payment made to the consultant’s account, matching the invoice amount.

- Allocation Record: A document detailing how the consultant’s time was allocated to different project tasks, ensuring that the cost is correctly attributed to the project.

Ensuring the identifiability and verifiability of costs in Horizon Europe projects can be a complex and challenging task. However, with the right tools and support, you can streamline this process and ensure compliance with ease. Kronis is designed to simplify grant management, providing robust solutions for cost documentation, allocation, and reporting.

Ready to take your grant management to the next level? Request a demo of Kronis today and discover how our platform can help you manage your Horizon Europe projects more efficiently and effectively.

Empower your team with the tools they need to ensure compliance and maximize the impact of your R&D projects. Get started with Kronis now!